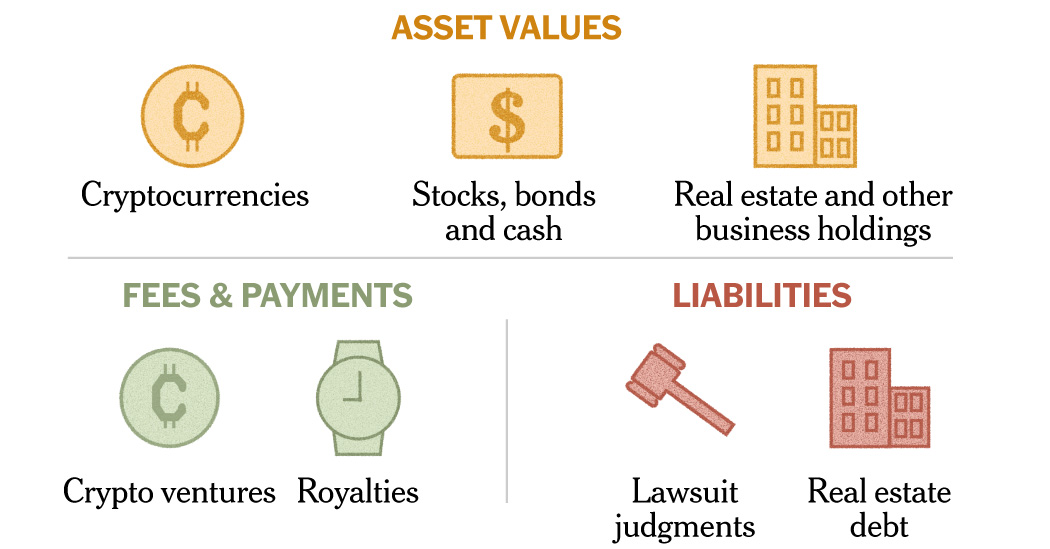

Asset Values

Cryptocurrencies

As much as $7.1 billion

Stocks, bonds and cash

At least $2.2 billion

Real estate and other business holdings

At least $1.3 billion

Fees & Payouts

Crypto ventures

At least $620 million since 2024, some shared with partners

Royalties

At least $11 million in 2024

Liabilities

Real estate debt

At least $100 million

Lawsuit judgments

$540 million plus interest

President Trump has long boasted of being a billionaire — even as journalists, accountants and the New York attorney general have cast doubt on just how many billions he is worth.

Mr. Trump’s precise net worth is unknowable, partly because the Trump family business is a privately held company that discloses little about its financials. The president also derives some of his wealth from real estate, the value of which can be difficult to estimate. And some of his assets are shared with family members or business partners, making it tricky to untangle what portion belongs to him.

Still, some of the president’s financial holdings — for example, those in the stock market and the cryptocurrency industry — are publicly known. And the annual financial disclosure that Mr. Trump must file as president offers a snapshot of the murkier elements of his business. It also lists his outstanding debts, including from a few recent legal judgments against him.

Together, that information shows that Mr. Trump’s net worth has soared in the early months of his second term, mostly thanks to his crypto investments, suggesting that he might now be worth $10 billion or more. Yet a vast majority of that sum is not liquid. He would have to unload investments and sell his stakes in various ventures to realize much of that wealth.

Here is a breakdown of what we know — and don’t know — about the president’s net worth.

Cryptocurrencies

Crypto is a relatively new area for the Trump family. But in just a couple of years, Mr. Trump has accumulated a sprawling array of crypto investments that touch virtually every part of the industry.

Memecoin

A massive portion of Mr. Trump’s wealth is only six months old: a so-called memecoin, $TRUMP, that he unveiled just days before his inauguration in January. (A memecoin is a type of digital currency tied to an online joke or mascot, and it typically has no function beyond speculation.) Mr. Trump and his partners still own the lion’s share of the $TRUMP coins that have been created.

At the current trading price of around $8.67, as of noon E.T. on July 1, those holdings amount to about $6.9 billion. But this value is not liquid: The coins owned by Mr. Trump cannot currently be traded, and any large sale would cause the price to crater. It is also unclear how much belongs to Mr. Trump versus his partners.

$TRUMP memecoin market value

Along with the value of the $TRUMP coins that the president holds, he also benefits from transaction fees every time the memecoin is traded. To date, these fees have totaled at least $320 million, which the Trump family shares with its business partners, according to Chainalysis, a crypto analytics firm.

World Liberty Financial

The president’s headfirst dive into the crypto industry has been highly lucrative — and not just because of his memecoin. The crypto firm that he helped start during last year’s presidential campaign, World Liberty Financial, has also generated a significant sum from the sale of its own digital tokens, known as WLFI.

A business owned by the Trump family is entitled to 75 percent of the revenue from token sales, after a $30 million threshold is reached and expenses are deducted. World Liberty said in March that it had sold $550 million in tokens, and then reported subsequent sales of $25 million and $100 million. The sales likely netted more — possibly much more — than $300 million for the Trump family, though the president’s precise earnings will not be known until he files his next annual financial report.

Mr. Trump also controls his own stash of more than 15 billion World Liberty tokens, according to his most recent disclosure. The tokens are currently not tradeable, making it difficult to estimate their value. For now, owning them simply allows holders to vote on some of World Liberty Financial’s business decisions.

But data collected by the crypto forensics firm Nansen shows that some of the tokens were originally sold at 1.5 cents apiece — consistent with pricing information that World Liberty circulated to investors last year.

That would put the value of Mr. Trump’s holdings at roughly $236 million.

And it’s possible that World Liberty will eventually allow the tokens to be traded, which could cause their value to skyrocket. The company has said it is working on making the tokens “transferable,” though it’s not clear exactly what that means. At a crypto conference in New York on June 25, one of World Liberty’s founders, Zak Folkman, hinted that an announcement could come in the next couple of weeks.

“Everybody is going to be very, very happy,” he said.

Stocks, bonds and cash

Trump Media & Technology Group

The second largest source of President Trump’s net worth, after the memecoin, is his stake in the publicly traded corporation that runs his social media venture, Truth Social. The president owns 115 million shares in the company, Trump Media & Technology Group, making his stake worth about $2 billion based on the current price of the stock.

But unless he sells the shares, this aspect of his net worth is theoretical, existing only on paper. And the value of Trump Media shares has fallen precipitously since his inauguration. At its peak, Mr. Trump’s stake in the company was worth about $6 billion.

Trump Media & Technology market value

Other investments

The president also has an expansive financial investment portfolio that was worth at least $236 million, according to his most recent financial disclosure, which covers 2024. The exact size of his portfolio is unknown because his financial disclosure reports these assets in wide ranges.

One entry in the disclosure indicated that Mr. Trump held more than $50 million in a money-market fund with no top value provided, making it impossible to determine the true maximum total of his holdings.

The New York Times previously analyzed the financial disclosure he filed last year to determine the breakdown of his holdings in bonds, cash and stocks.

If Mr. Trump held the low end of the range for each asset listed, bonds would have accounted for about 60 percent of Mr. Trump’s portfolio; cash and similar investments for roughly 30 percent; and stocks for less than 10 percent. Municipal bonds represented nearly 80 percent of Mr. Trump’s bond holdings, according to the minimum values reported.

At minimum, Mr. Trump’s investment portfolio of stocks, bonds and cash produced $13 million in dividends and interest last year.

Real estate and other business holdings

Before Mr. Trump was a crypto mogul, he drew much of his net worth from the value of his real estate — hotels, residential properties, golf clubs and commercial office towers. This business has ebbed and flowed over the years, though it remains important for Mr. Trump.

It is difficult to determine the exact value of his real estate; he offers only estimates in his financial disclosures. For example, he valued 19 different real estate assets at more than $50 million each in his latest disclosure, with no reported maximum. All told, he valued his properties and other business holdings at a minimum of $1.3 billion, excluding Trump Media and World Liberty.

The New York attorney general accused Mr. Trump of inflating his real estate values to secure favorable loans from banks, prompting a monthslong civil trial that resulted in a nearly half-billion-dollar judgment against him.

These properties also generate revenue, though he does not reveal his expenses or investments in the properties, so profit or loss cannot be determined. In 2024, the top two revenue generators were in Florida: the Trump National Doral golf club near Miami ($110 million) and his Mar-a-Lago private club and estate ($50 million).

Royalties

At least

$11 million

in 2024

Gold watches. An electric guitar. A coffee-table book. Sneakers and a Bible.

Mr. Trump has put his name on a wide variety of consumer products — and these deals generate a steady flow of royalty payments for him. In 2024, he received more than $11 million in such payments, according to his financial disclosure.

Debts

More than

$640 million

plus interest

Real estate

Like almost any real estate investor, Mr. Trump has sizable loans on some of his properties. His company said it recently paid off a $160 million loan on its 40 Wall Street office building in Manhattan, though he still owed more than $100 million on other properties, according to his latest disclosure.

Lawsuit judgments

The president’s biggest debt stems from his recent legal troubles: the nearly half-billion-dollar judgment from the attorney general’s office and two lawsuits brought by the writer E. Jean Carroll. In one of those two cases, a Manhattan jury ordered Mr. Trump to pay Ms. Carroll $83.3 million for defaming her after she accused him of sexual assault.

A separate jury had earlier awarded Ms. Carroll $5 million after finding that Mr. Trump had sexually abused her in a Bergdorf Goodman dressing room in the mid-1990s and had defamed her in a Truth Social post.

After these courtroom losses, Mr. Trump had to secure hundreds of millions of dollars in so-called appellate bonds, which spare him from paying the judgments while he appeals them. But to do so, he had to pledge a significant amount of his assets to the companies providing the bonds. And if he ultimately loses the appeals, Mr. Trump will owe the full amount of the judgments, plus significant interest.