Congressional Republicans just passed President Trump’s sprawling domestic policy bill that extends and expands tax cuts, while slashing Medicaid, food benefits and clean energy initiatives to pay for them — but only partly. The bill favors the wealthy, and low-income Americans stand to lose the most.

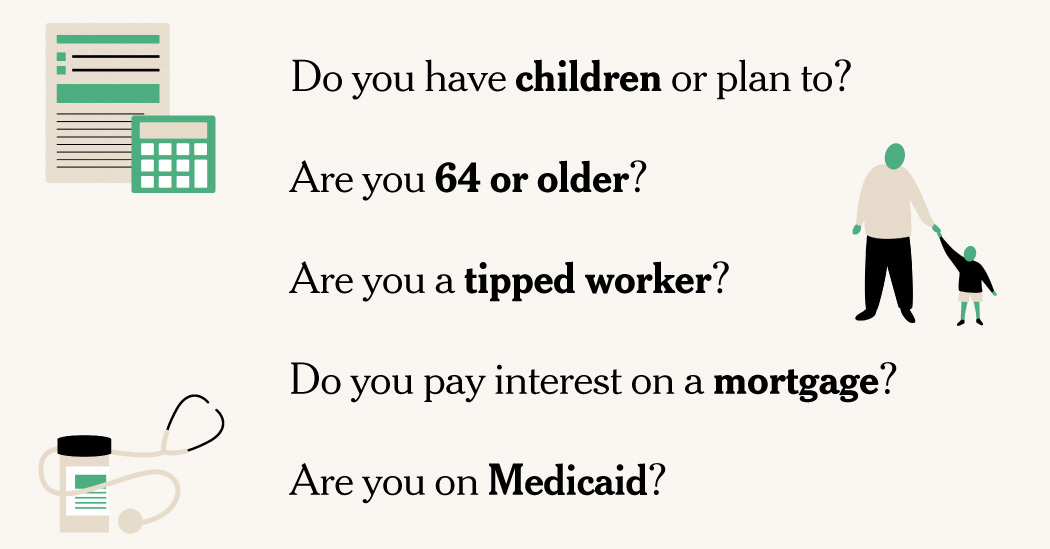

What could the bill mean for your pocketbook? Answer these questions to learn more about the individual impacts of the wide-ranging legislation. (Your answers are not tracked by The Times.)

Jump to a section:

At the heart of the bill is a roughly $4 trillion tax cut that extends the cuts Republicans passed in 2017. Without this extension, most Americans would see a tax increase.

These tax cuts come at a cost. According to the Congressional Budget Office, the bill adds $3.3 trillion to the national debt over the next decade.

Do you pay federal income taxes?

Do you take the standard tax deduction?

Are you 65 or older?

Do you own a home in a high-tax state like California or New York?

Are you a tipped worker?

Do you receive overtime pay?

Do you plan to buy a car?

Do you pay interest on a mortgage?

Have you experienced a big loss because of a storm, fire or other disasters?

Do you donate to charity?

Do you earn more than $500,000 a year?

Do you own a business?

Do you own or are you considering buying firearms?

Are you a whaling captain or a fisher living in Alaska?

Despite reducing or eliminating certain safety net programs, the Trump administration has been exploring several options to encourage Americans to have more children, including tax cuts and other investments.

Do you have children?

Are you planning to have a baby soon?

Do you intend to adopt a child?

Will you inherit wealth or business worth $15 million or more soon?

To offset some of the tax cuts, the bill makes steep cuts to health care and food assistance benefits for low-income Americans.

Are you on Medicaid?

Do you use food stamps?

Do you have health insurance under Obamacare?

Do you have a health savings account, or want one?

The bill adds limits to student loan borrowing and makes changes to financial aid eligibility and uses.

Have you already taken or will soon take out federal loans for college?

Do you plan to borrow money for your child’s college education?

Do you hope to borrow money for graduate school?

Do you have a 529 savings account?

Are you filling out the FAFSA?

Do you plan to apply for a Pell Grant?

Do you or your children attend a university with a large endowment?

The bill rolls back tax credits for clean energy, a policy Mr. Trump campaigned on.

Are you planning to make energy-efficient home improvements?

Do you want to buy an electric or a plug-in hybrid vehicle?

The bill has prioritized additional funding for immigration enforcement, and specifically includes collecting more fees from certain noncitizens.

Are you a noncitizen without a green card?

Are you an immigrant who sends money abroad to friends or family?

Your results

|

1. Preserve existing tax brackets |

— |

|

2. Extend and increase standard tax deduction |

— |

|

3. Increase tax deductions for seniors |

— |

|

4. Increase cap on state and local tax deductions |

— |

|

5. Add tax deduction for income from tips |

— |

|

6. Add tax deduction for overtime income |

— |

|

7. Add tax deduction on auto loan interest |

— |

|

8. Preserve limit on mortgage interest deduction |

— |

|

9. Preserve restrictions on loss deduction |

— |

|

10. Add tax deduction for donating to charity |

— |

|

11. Extend alternative minimum tax exemption |

— |

|

12. Increase tax deductions for pass-through businesses |

— |

|

13. Eliminate a tax on silencers and certain firearms |

— |

|

14. Add tax breaks for Alaskan whalers and fishers |

— |

|

15. Increase child tax credit, with tightened rules |

— |

|

16. Deposit $1,000 into a “Trump account” for newborns |

— |

|

17. Make adoption tax credit refundable |

— |

|

18. Extend and increase estate tax exemption |

— |

|

19. Add work requirements for Medicaid |

— |

|

20. Add work requirements for food stamps |

— |

|

21. Tighten Obamacare rules |

— |

|

22. Expand HSA access to more people |

— |

|

23. Eliminate tax credits for low-emissions electricity sources |

— |

|

24. Eliminate tax credits for clean energy vehicles |

— |

|

25. Restructure student loan repayment programs |

— |

|

26. Limit Parent PLUS loan amounts |

— |

|

27. Limit graduate school loan amounts |

— |

|

28. Expand eligible 529 expenses |

— |

|

29. Remove some assets from financial aid calculations |

— |

|

30. Change eligiblity rules for Pell Grants |

— |

|

31. Increase taxes on university endowments |

— |

|

32. Add and increase immigration fees |

— |

|

33. Add a tax on money sent abroad |

— |